Silver has long been part of money, trade and shelter for wealth through storms and fair weather. As markets ebb and flow, silver offers characteristics that appeal to savers, investors and people who like having a tangible backup.

The notes below unpack five long-term benefits that silver brings to a plan aimed at steady finances and risk control.

1. Diversification and Reduced Concentration Risk

Holding silver alongside cash and equities spreads exposure across asset groups. A mixed basket that includes metals can soften swings when stock markets wobble, helping portfolios breathe a bit easier. The effect is plain: different assets often move out of step, so losses in one area may be offset by gains or steadier behavior in another.

This separation of exposures is not magic, just math and history repeating itself to some degree. Portfolios that lean on a single sector risk major pain when that sector stumbles. Keeping silver in the mix lowers the odds of having all your eggs in one basket and gives you options when markets tighten.

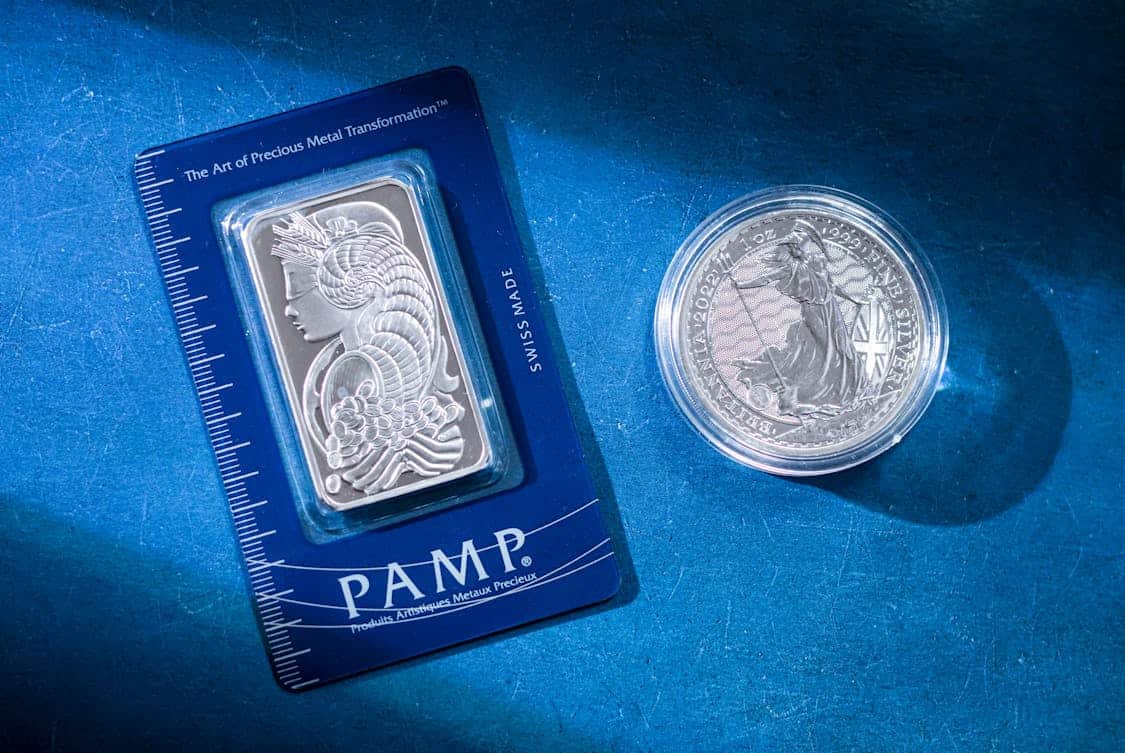

Silver can act as an alternative claim on wealth without the counterparty strings of some financial instruments. Physical pieces sit outside banking ledgers and custody accounts, which many find comforting for stress scenarios. That tangible nature makes silver both a hedge and a hedge-like asset—practical and psychological at once.

2. Inflation Hedge and Purchasing Power Preservation

Over long cycles, currencies lose purchasing power; having an asset that tends to hold real worth helps protect buying power. Silver has tracked consumer prices in many eras, showing periods where it preserved buying potential when paper money weakened. That historical track record draws attention from those building a buffer for future costs.

The mechanics are simple: metals are priced in currency units, and rising general price levels often nudge metal prices upward, too. That linkage is uneven and not guaranteed month to month, yet over multi-year spans patterns emerge that favor holders. For people saving for later-life needs or large purchases, silver can work as a complementary guardrail.

Put another way, silver provides a tangible yardstick when fiat money stretches thin. It won’t stop every shock, but it reduces the pace at which purchasing power erodes. Call it an old-school inflation dampener—time-tested and hands-on.

3. Liquidity and Ease of Conversion

Silver is traded globally and can be bought or sold in many markets, from local dealers to major exchanges. That wide network means you can typically turn metal into cash reasonably quickly when a need arises. It’s not instant like a bank transfer, yet it’s far from illiquid, especially for standard coins and bars.

If you’re considering buying or selling physical silver, it’s wise to connect with reputable silver dealers who can offer fair pricing and smooth transactions.

Different forms of silver carry different ease of conversion: widely recognized coins trade faster than obscure rounds, for example. Buyers and sellers prize recognizability, so mainstream products command tighter spreads. That practical detail matters when you want access to funds without long waits or painful discounts.

Having a liquid asset helps with short-term shocks and unplanned bills, which feeds into longer-term stability. A rainy-day requirement met by a sale of metal can spare more permanent portfolio changes. In short, silver can be a cash-adjacent tool when immediacy matters.

4. Industrial Demand Supporting Long-Term Value

Silver isn’t only a monetary relic; it plays vital roles in industry, medicine and technology. Photovoltaics, electronics and certain medical devices rely on silver’s conductive and antimicrobial traits, creating steady baseline demand. This ongoing industrial appetite can provide structural support for prices over time.

Industrial cycles add nuance: demand rises and falls with innovation and macro activity, but the metal’s dual use gives it extra legs compared with pure monetary metals. When manufacturing ramps up, extra buying pressure can buoy markets, while during slowdowns the monetary view tends to matter more. Such twin demand streams give silver a layered market profile.

Investors often like assets with multiple demand pillars because they spread revenue drivers and reduce single-point failure. A metal needed by industry and sought as a savings vehicle fits that bill. In practice, this helps silver avoid being pigeonholed and widens the base of interested market participants.

5. Portfolio Insurance and Behavioral Benefits

Holding silver can act as insurance against systemic shocks that rattle conventional assets; it sits in portfolios as a contingency layer. Insurance has a cost, sure, but the calm that comes from having a standby asset can change behavior for the better. People who sleep well at night tend to make fewer rash moves when markets toss and turn.

Behavioral finance shows that confidence and perceived stability shape decisions, sometimes more than raw returns. If silver reduces anxiety around extreme outcomes, that alone has long-term value by keeping investors on course. It’s not just the metal’s price history; it’s the decision-making climate it helps create.

Moreover, having a tangible reserve shifts planning from abstract projections to concrete options. That shift nudges people toward planning that includes emergency liquidity and structural cushions. Small behavioral nudges—holding a little metal, labeling it for emergencies—can cascade into steadier financial habits over decades.